Course Duration: 6 Month

कोर्स अवधि: 6 महीने

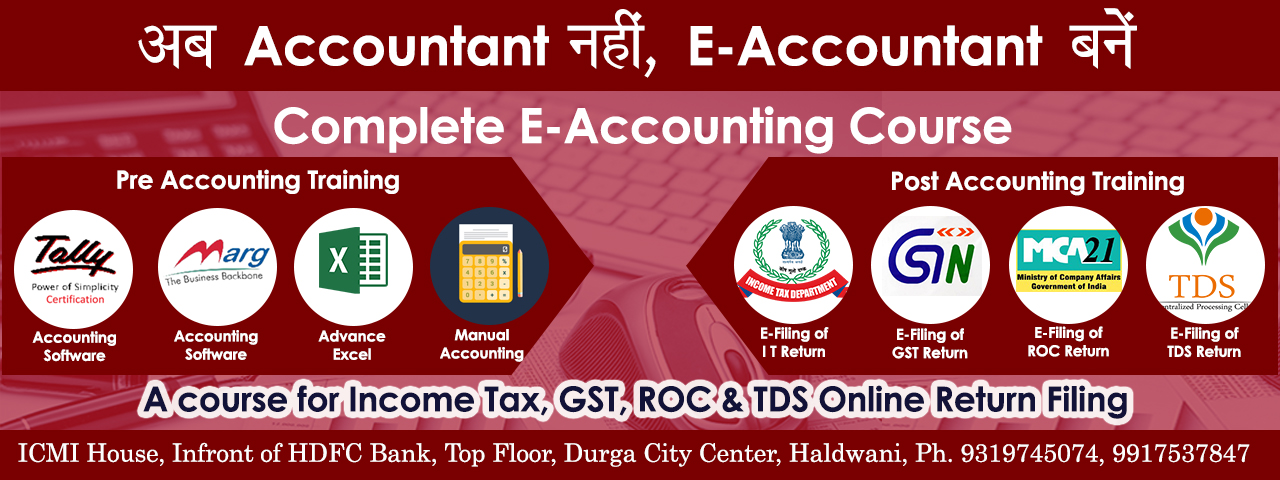

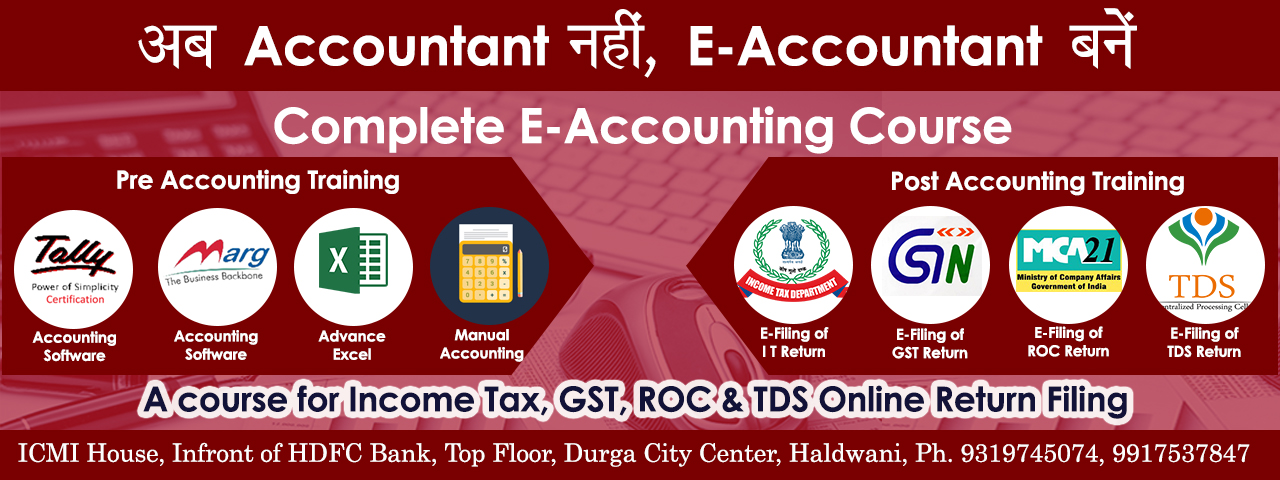

Every business, from the smallest start-up to the largest corporation, needs accountants. Accounting is also integral to almost all management positions within any company. With this Certified E- Accountant and Tax Consultant course, student will have a strong grounding in the skills necessary to meet most accounting needs of any business. This course covers not only accounting but also the taxation part. After completion the course student have strong knowledge practical experience of accounting and Taxation.

You will learn both theory and practice of professional accountancy, as well as Taxation skills. You will be able to produce and understand financial reports and make recommendations. And you will have a strong grasp of taxation and tax regulations as they relate to business entities.

Course Faculties: Only Professionals Like CA, CS, CMA, MBA Finance

Course Delivery: By regular interactive mode

Eligibility : 10+2 from any stream

Course Structure

Course Outline : Modules Topics

Module 1 : Computers Fundamentals

Microsoft Windows

Microsoft Word

Microsoft Excel

Microsoft Power Point

Accounting Fundamentals

Meaning & Components of Accounting

Objectives of Accounting

Accounting Principles & Concepts

Accounting Process

Accounting Cycle

Making Financial Reports

Module 3 : Computerized Accounting

Accounting in Tally ERP 9

Making Reports in Tally ERP 9

Accounting in Marg

Making Reports Marg

Module 4 : Online Return Filing

Income Tax introduction

Tax Calculation & Preparing Returns

Income Tax Return Filing

Tax Deduction at Source

TDS Accounting

PDS Payment & Returns

Tax Collection at Source

Module 5 : Goods and Services Tax (GST)

GST introduction & Registration

GST Billing & E-Way Bill

Input TAX Credit and Payment

GST Return Filing

GST Updates

Module 6 : On line Banking

Internet Banking

Using E-Wallets

Digi Payments

Online Shopping

Module 7 : Overview of ROC and Stock Market

Overview of ROC

Registration of Company

Overview of Stock Market

Overview of Financial Analysis

Overview of Forex

Module 8 : Soft Skills

CV and Resume Writing

Positive Attitude

Mock Interview

Presentation Skills

Group Discussion

Personality Development

• Account Executive

• E-Accountant

• Senior Accountant

• Account Officer

• Assistant Manager

• GST Participant

• Tax Professional

• Account Auditor

• Finance Analyst

• Account Manager

1. Free course material. Worth Rs. 1800.

2. Free educational version software.

3. Conceptual to advance learning of Accounting

4. More than 10,00,000 users, Means more job opportunity.

5. Job assistance by MARG Academy.

6. More comfortable learning environment

7. Convenience and flexible time of class

8. Classes by professionals experts